8×8 Analyst Summit 2025: Transforming in more ways than one

International focus

Cavell encounters and advises a lot of US-based providers looking to expand into Europe. Many of the world’s technology trends originate in the US and ripple across the Atlantic and globally – one of technology providers’ main challenges is attempting to ride these waves . Many of the US’s leading UCaaS and CCaaS providers have struggled to make great strides in European markets, outside of the UK or multinational US firms with global sites. It’s fair to say the same is true of 8×8. It has seen impressive UK growth, but on the continent of Europe, less success.

“We (8×8) will continue to think globally, but act locally.” – 8×8 CEO, Samuel C Wilson

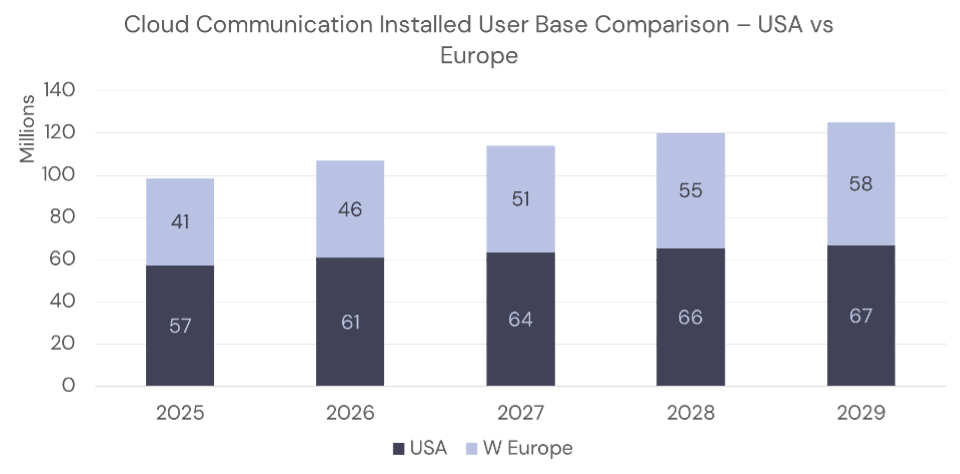

Despite this apparent focus on the wider world and Europe, few providers have developed GTM strategies that will allow them to access wider markets in Western Europe. Geographic expansion into Europe seems obvious. The US market is incredibly competitive: Cavell tracks more than 400 cloud communication service providers in the market, and Western Europe promises a comparable market in terms of addressable users for both UCaaS and CCaaS.

By 2029, the US and Western European countries will cover more than 110 million cloud communications users. Western European countries, including the UK, France, Germany, Netherlands, and Spain, will represent around 45% of that total. So, in terms of the UCaaS addressable market, Europe seems an attractive prospect. It’s the same story when you look at CCaaS, a key aspect of 8×8’s portfolio:

“There will be 600k+ new CCaaS agents deployed in the US and 400k+ deployed in Western Europe over the next 4 years, with annual market revenue increasing by $0.6bn in the US and by $0.4bn in Western Europe over the same time frame.”

The gap in terms of market opportunity between Europe and the US is closer than you might think. Hence, the ‘expansion appeal’ for US firms looking to grow.

Many cloud-native providers talk a good game, but few have succeeded in this expansion. 35% of 8×8’s employees are already based in Europe, so they are already more invested than most. Also, by holding its primary analyst summit outside of the US – at the home of one of its more high-profile international customers in Southampton Football Club – 8×8 further indicates its international intent.

Overcoming some of the current geopolitical issues—including US and European discord—might present additional barriers to this, which are not unique to 8×8.

Business & portfolio transformation

There has been a lot of progress since last year’s analyst summit, which took place in the slightly warmer San Diego Zoo.

8×8 has radically reduced its debt, cutting it by more than 30%. Its overall growth is more complicated to analyse, with Fuze still impacting total figures. As a public company on the NASDAQ this can’t all be disclosed. However, its core business is apparently growing and will eventually lead to publicly reportable overall growth, probably within the next 12 months.

The more general transformation outlined by CEO Samuel Wilson, seems to be more orientated toward solution-based outcome selling, rather than a feature-to-feature battle against its competitors:

“It’s very hard for a software company to differentiate on features. What we (8×8) can differentiate with is passion – for our customers and our services.”

8×8 is trying to reposition the company as one capable of offering a full customer experience (CX) portfolio. Currently, their offering is much more orientated around the traditional contact center and customer service provision.

That perception is despite the huge strides 8×8 has made in CPaaS. The integration between UCaaS, CCaaS, and CPaaS is a key strategic goal, with its new JourneyIQ covering all three areas. Wilson stated that CPaaS represents the fastest-growing part of their business, as digital communication channels become an even more critical aspect of customer experience provision. Cavell has researched messaging provision, which is currently the main use case for CPaaS capability. 8×8 used the summit to announce that its contact center solution now supports Rich Communication Services (RCS), to bolster its CPaaS messaging capability further. The company has seen particular success in Asia with its CPaaS messaging capabilities, and the integration into its contact center solution further aligns its offering.

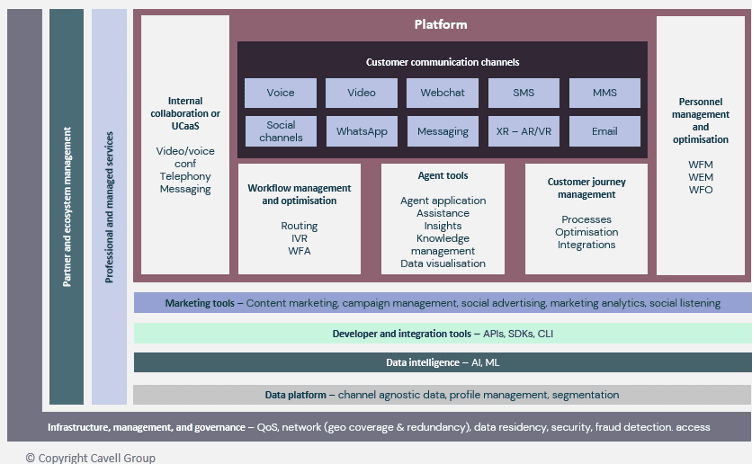

Nevertheless, there are shortcomings in it’sCX portfolio, for instance across its marketing and sales capability. Its Engage product, which is still in early access BETA, does offer a broader range of capabilities outside of the traditional contact center and agent models, but there is still a way to go to have a full multi-channel CX solution. Cavell has tried to outline what a full CX portfolio looks like, and it is extensive, with very few vendors covering all areas:

8×8 isn’t looking to cover all of these areas. It will use its Technology Partner Ecosystem – including partners such as Verint, Calabrio, and Smarsh – to fill key gaps in customer requirements that aren’t covered directly by its own proprietary technology.

Cavell has been tracking the pivot toward CX from traditional UC for a number of years. The commoditisation of unified communications, particularly in basic cloud voice capability, partially driven by market incursions from Microsoft and Zoom, necessitates a move to CX solutions for higher margins and revenues, along with stronger customer retention.

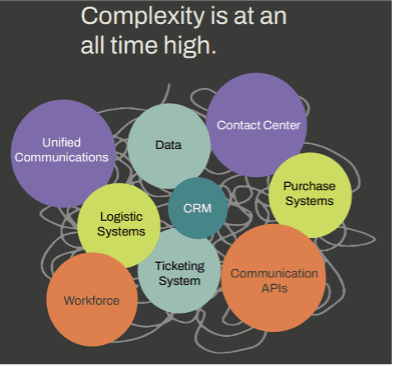

With its growing portfolio and partner solutions, 8×8 wants to solve the most important customer issue it sees: complexity.

This relates directly to Cavell’s hypothetical ‘Intelligent Workplace’ concept. Enterprises want to achieve fully integrated systems that allow data and intelligence services to flow simply across all areas. 8×8 seems to be aligned with the enterprise end goals and is focusing on marketing-specific outcomes to achieve these. This requires continued pivoting from 8×8, including expanding its professional services capability and partner ecosystem.

AI differentiation

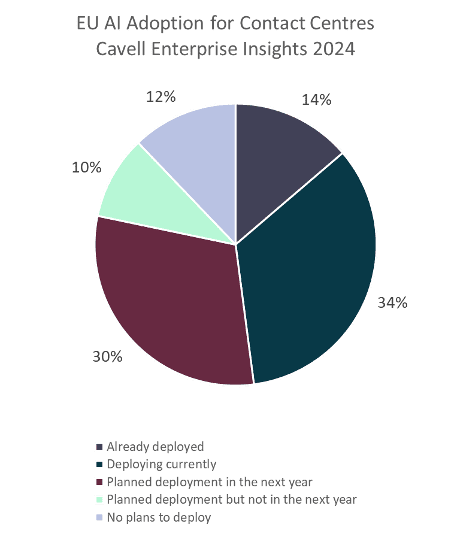

8×8 acknowledges that it is increasingly difficult to differentiate from competitors with features and function sets. Surge development teams can cut product feature gaps in weeks. The same is true with AI. Cavell’s own research found that 93% of communication providers are either planning to build AI into their solutions, if they haven’t already done so.

The key question is, how do you differentiate your AI capabilities from those of your competitors? Many of the key features and functions across UC and CC are available in various flavours from multiple vendors.

8×8 is refocusing, in line with the outcome-based orientation outlined above, on ‘Pragmatic AI’. 8×8 makes a clear distinction in the context of AI technology between evolutionary and revolutionary AI. A revolution fundamentally changes existing workflows, behaviours, or industry structures, requiring new infrastructure, cultural shifts, or business models. On the other hand, an evolution enhances efficiency, usability, or performance while fitting within current workflows, industry norms, and user expectations.

Pragmatic AI focuses on simple evolutionary use cases and outcomes whilst offering the flexibility to look at more revolutionary AI when the customer is ready. At this stage, 8×8 believes that customers need help understanding and applying AI in their businesses.

This aligns with Cavell’s own research. Customers have said that improving efficiency and productivity with artificial intelligence is a top strategic priority, but knowing exactly how they do that is more challenging.

This issue isn’t just confined to end customers. Delivery partners, primarily resellers and managed service providers, also need support. Both in terms of the solutions they offer and how they monetise them.

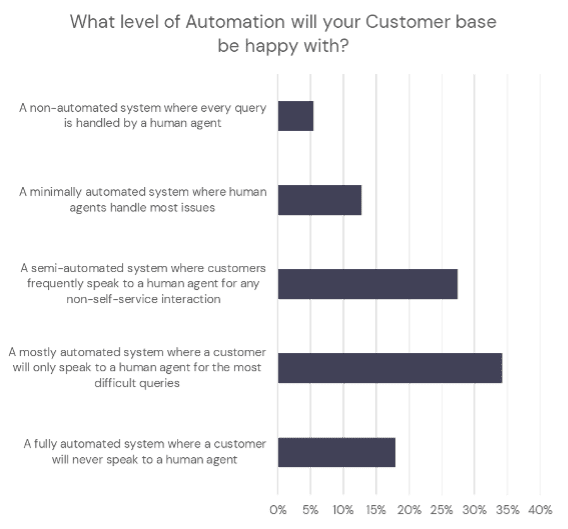

The news of 8×8 AI Orchestrator provided an example of this simplification process. This solution can integrate decision flows between multiple AI bots and vendor solutions. This way a business with multiple bots can ensure that information is routed to the right place regardless of the bot used. The key premise behind this kind of development is that the demand for automation and self-service tools will increase.

Cavell’s research shows that this is the case, but technology providers need to overcome consumer concerns with automated systems. A typical enterprise might rely on 3-5 chatbot vendors, each focused on specific use cases.

8×8 is concentrating on providing agile and flexible AI deployment and commercial models so that it can help both customers and partners confirm their current capabilities around AI and then develop those in the future at their own speed.

This can be partially achieved in a number of ways: with a more vertical focus, so they can go deeper into specific areas and create replicable examples and use cases; and focusing more on pay-as-you-go for anything, including ecosystem items. This way, customers and partners can build up their own solutions to meet their unique customisable requirements.

The question is, how scalable is this? There was still some uncertainty about how this flexibility would work from an SKU, bundling, and commercial perspective. 8×8 will need to find these answers to help customers and partners achieve the critical outcomes.

One of the key themes that emerged from this year’s summit was the need for good routes to market. All of 8×8’s testimonial customers who were present at this year’s event voiced their requirement for additional support and services from 8×8. 8×8 can’t deliver this at scale, to all of its customers globally. It, like many international technology providers, needs to expand its network of channels and delivery partners.

The type of partner is less important when it comes to traditional definitions, whether it be a communications service provider, reseller, or managed service provider. Managing Director of EMEA, Jamie Snaddon, hosted a partner panel on day two of the summit exploring partnership with 8×8.

The partner panel with Wavenet, Croft, and Digital Space Wholesale discussed how competitive the market is for 8×8 to attract partners and stand out as a vendor because of factors like pricing, marketing help, and exclusivity all present challenges. All three partners mentioned that trust, access, and support are the main reasons they chose to work with 8×8.

Customers need further support and that was made clear during 8×8’s event and has been clear in other vendor summits. Professional, value-added, and managed services – covering user support, change management, optimisation, and future ideation – are all areas where partners can help. As technology vendors can’t replicate this at scale across the globe, a channel-focused GTM is critical.

Cavell’s Channel Insights looks at the channel globally. In the UK, as an example, Cavell tracks nearly 7,000 channel providers, of which 73% advertise UCaaS but only 34% offer CCaaS. This presents a challenge for converged UC and CC providers like 8×8. There are a range of vendors: Zoom, RingCentral, and Dialpad, who are all targeting a limited number of truly capable channel partners. Who will win, and why? Commission structures, SLAs, technical, and sales support are going to be the key factors that help make the difference for these vendors.

GTM and the channel appear to be the key battlegrounds for communications vendors. Those who succeed in choosing, attracting, and optimising their delivery partner networks will grow most over the coming years.

No vendor can do this in isolation. Microsoft and Cisco have seen the greatest success by establishing strong partner networks. Although it is not looking to emulate those networks, 8×8 is betting heavily on its channel, and this is a key aspect of its overall transformation. Wilson also outlined that 8×8 will be more aggressive against its competitors on the UC and CC sides by going on the offensive, both in terms of pricing and partnerships. More news and details will follow.