Azure for Operators – What It Means For Service Providers?

Microsoft announced the launch of Azure for Operators (AFO) in Autumn 2020.

This is the start of Microsoft bringing together a series of virtualised network functions and other applications into the Azure cloud for service providers to utilise.

The ambition may initially be for 5G and some traditional voice services but seems a lot broader moving forward.

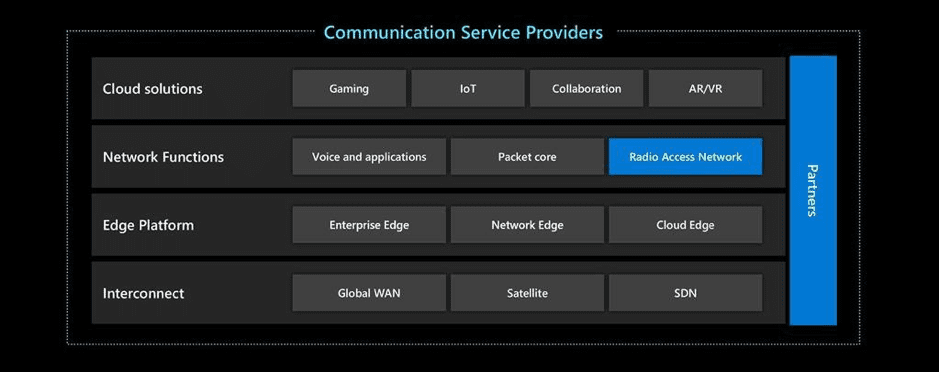

Below is the diagram that showed how Microsoft positioned the different assets they have in the ccosystem which may be exposed in time to come.

Table of Contents

What is Azure for Operators?

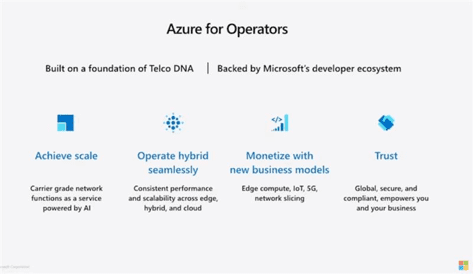

Azure for Operators doesn’t immediately herald the release of a selection of new solutions and services. Effectively, it is a segmentation of Azure services focused on new operator solutions combining cloud, cellular, and edge computing capabilities.

Azure for Operators constitutes a combination of existing technologies combined with recently acquired products and platforms. The solution set it is to be expanded in the future as additional capabilities are developed internally by Microsoft or acquired and integrated.

Several primary partners have already been announced by Microsoft.

These partners are already using some of the solutions with Azure for Operators for various reasons.

Partners announced include:

-

- AT&T

-

- Celcom

-

- Deutsche Telekom

-

- Telefonica

What does Affirmed Networks bring to Azure for Operators?

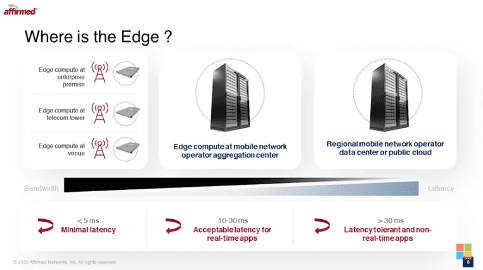

Latency reduction is one of the primary gains of Edge computing. Offering service providers and customers the ability to process with reduced latency could be an attractive, and enterprise use case in retail, hospitality, and manufacturing sectors are apparent.

As well as expertise in Edge computing, Affirmed Networks also provides capability and solutions to power the 5G core. It offers the ability to have a more agile and faster 5G core software development models.

Network slicing also opens new possibilities for containerised workloads, management of different connections, and the provision of multi-tenanted private services over shared infrastructure. All services which may appeal to service providers.

Why has Microsoft launched Azure for Operators?

On one hand, you could say this is Microsoft just reacting to the increased trend of service providers looking to move more and more functions into the cloud – both in service provider’s own operations and in the services they provide to their customers.

This appears to be a reaction to this growing trend and to the progress Amazon and Google have also made in securing business from the service providers and related technology vendors with their own platforms – Amazon Web Services (AWS) and Google Cloud Platform (GCP).

Microsoft is acknowledging that service providers could form an important customer base and provide a route to market in infrastructure as-a-service (IaaS) and platform as-a-service (PaaS) sectors.

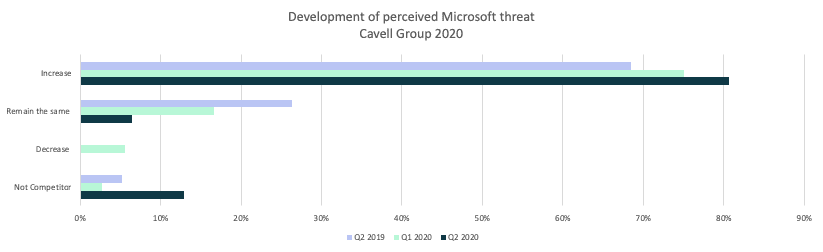

This is another signal that Microsoft appears to be trying to convince service providers that they are a force for good, and not a leading competitor.

Cavell Group’s research of cloud communications service providers showed that Microsoft was perceived as their biggest competitor and this perception has grown in the last 12 months.

The launch of Azure for Operators is a progression in offering “focused” operator services and may go some way to address these concerns.

Microsoft is also recognising a growing market opportunity in both Edge computing and 5G.

Operators are still approaching 5G as a traditional service and Microsoft wants the 5G network core to be run by Azure on the Azure cloud. 5G, by its nature, demands an agile and flexible core infrastructure – which Microsoft may believe operators are not equipped to provide currently.

Edge computing also provides an opportunity with the future of business networking driven by application requirements.

Latency, self-healing networks, and the intelligent Edge are all central to the future of more complex applications. Microsoft see this an area where Azure’s capabilities may prove tempting for service providers and operators.

Data possession and management is the cloud battleground of the future.

Data collection is key, and it can be uses to build complex intelligence services like machine learning (ML) and artificial intelligence (AI) systems. These value-added services are the goal that many companies are striving for now.

This is especially true in networking, with companies like Cisco, Juniper, and VMWare all striving to build smarter, more automated, and eventually self-healing networks.

Microsoft sees a similar opportunity in its increased service offering to operators. By integrating itself into 5G, IoT and Edge networks, the amount of data available to Microsoft relating to consumer patterns, trends, and network usage will grow massively.

This data can then be used not just to improve the quality of the network but also dictate how services are developed and operated, giving Microsoft a competitive advantage in the marketplace.

What are the benefits of Azure for Operators for service providers?

In essence, Microsoft’s long-term proposition to service providers is to host virtualised network elements and for service providers to consume some of their key applications from the Azure cloud.

Key benefits for service providers could include the ability to:

-

- Provide global scale and ability to deliver in multiple countries.

-

- Integrate into other relevant services that are also in the Azure cloud (Data intelligence services such as ML and AI etc.)

-

- Save OPEX and CAPEX as some of the physical network elements will no longer be required and service providers can consume them on a consumption basis.

-

- Integrate with other Microsoft applications and services which are present in the Azure cloud.

-

- Take up a commercial and operating model tailored to service providers.

What will be interesting is what additional elements and applications will be offered as we move forward.

One of the criticisms of Microsoft has been its ability to provide an appropriate service wrap and commercials that are attractive to service providers, so it will be interesting to see how this emerges.

At launch, Microsoft mentioned use cases for Voicemail, Global Interconnect, and Enterprise Voice but it’s clear many others will come.

Service providers will be considering their ability to compete and differentiate in the future. What elements of their services will they want to move to the cloud and what applications do they still want to manage and run internally, whether in the public or private cloud?

They will also be considering the key benefits of Microsoft, AWS, or Google partners in this process, as well as many of the traditional vendors who have been virtualising their own services like; Ribbon, AudioCodes, Oracle, Nokia, and Eriksson etc.

How will Azure for Operators impact the cloud communications industry?

It does appear that it will take some time for service providers to realise the value of deploying new services in Azure and for Microsoft to align its business to demonstrate clear value from Azure’s infrastructure, and possible integration into other Microsoft assets.

Azure for Operators could have an immediate impact on areas such as Global Voice Interconnect as the combination of Metaswitch and Azure’s global scale, impacts vendors and service providers in that field.

Interestingly, provision of voicemail was also shown as an initial use case. This is a product that causes service providers problems with supporting legacy services so cloudification in this area may provide compelling short term OPEX and CAPEX benefits.

As the service develops, Cavell Group will be looking at the commercial service models and any new use cases that show the benefit of integration with other Azure services before judging its overall impact. Be sure to follow our LinkedIn page for updates as they happen.

It is apparent immediately that some of the vendors and providers who are providing wholesale voice interconnect services are going to be affected.

What are the key considerations for service providers and operators?

Azure for Operators is currently a strategic affirmation and a new bundling of products together to highlight the services operators can receive from Microsoft.

There is a desire to build new product sets and integrate more of these products together – especially from the recent Affirmed Networks and Metaswitch acquisitions to build on the mutual capabilities.

Azure’s goal is to integrate as many workloads as it can under its banner. Operators are a key part of this as they include so many functions and systems under their banners.

Adoption of Azure for Operators could provide a mixed result.

Service providers and operators will lose traction in areas of development and technology that were seen as theirs traditionally, but arguably they were already struggling to keep pace in development with the latest technologies.

They will gain access to the large development teams working on new solutions hosted in Azure, both in-house at Microsoft from the Metaswitch and Affirmed Networks teams, but also from the broader Azure ecosystem.

End customers may also receive future benefits from further integrations with Azure, especially those customers using Microsoft 365 and Azure hosted solutions.

A final consideration will be the margin that service providers can generate currently and how that changes in this model.

Several service providers have depreciated assets in the delivery of certain services alongside the rising OPEX costs to support legacy environments.

This will be a crucial calculation when exploring the viability of Azure for Operators.

Next: Watch Matt Townend and Finbarr Begley discuss what Azure for Operators means for service providers.

Share this post

Matthew Townend

Executive Director at Cavell, Matt Townend oversees the business as one of its founders and acts as lead consultant on many of its projects. As well as running Cavell’s consulting and research businesses, he is also Director of the Cloud Communications Alliance, the international association of cloud comms providers. Matt combines practical business experience, having previously held senior product, sales, and marketing roles for service providers with his vast market analyst & consulting experience.