Huge Growth to Come in Microsoft Teams Telephony Market

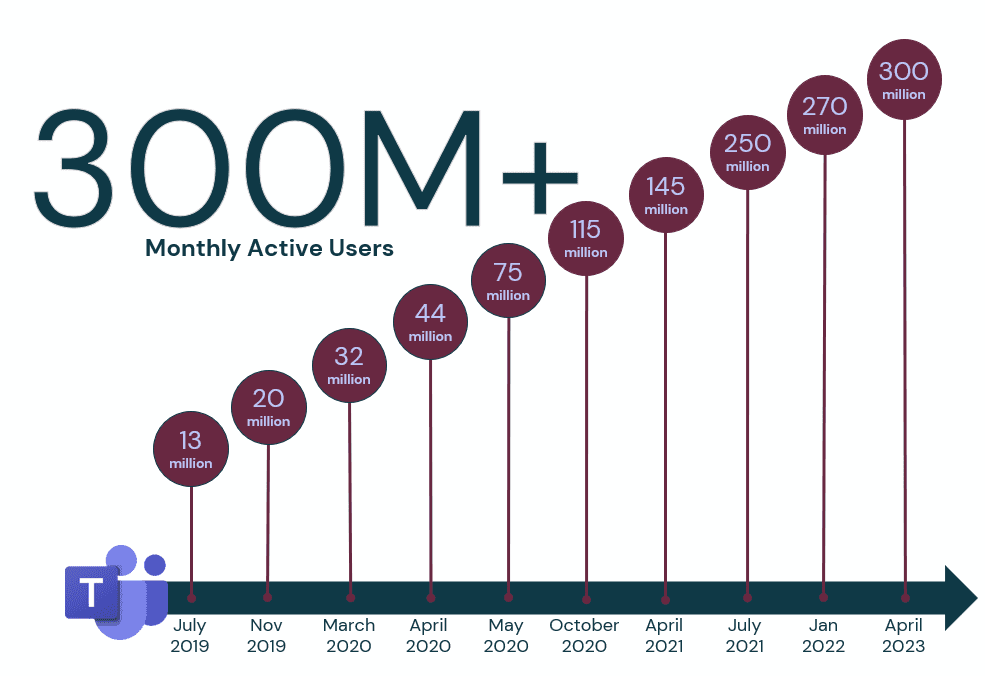

(Article updated Q3 2023) In the first half of 2023 Microsoft revealed that its collaboration platform, Microsoft Teams, was now being used by more than 300 million users every month. That’s a pretty startling figure as you only have to travel back in time to November 2019 for the first public user announcement when there were only 20 million users.

Teams’ success can be attributed to various factors including its inclusion within Microsoft’s Office 365 productivity suite, and a global pandemic which radically boosted its relevance to everyday businesses and, in turn, its user numbers.

Microsoft Teams user growth moving from daily active users (DAUs) to monthly active users (MAUs) during 2021

Putting those factors aside though, huge credit also has to go to Microsoft for putting the hefty weight of its development resource behind the platform. Since its initial release at the start of 2017 Microsoft has accelerated the platform’s development, catching and overtaking preestablished collaborative rivals such as Slack, taking Teams to a position of market leadership.

Teams now includes all of the features you would expect in a collaboration application and combines them with new innovative functions designed to improve user experience within the platform. All of the communication elements you would expect are included: instant messaging, voice conferencing, and video meetings.

Table of Contents

Huge scope for Teams telephony adoption

One feature that isn’t included – as standard – is telephony. Teams users need to enable PSTN connectivity through a growing number of options.

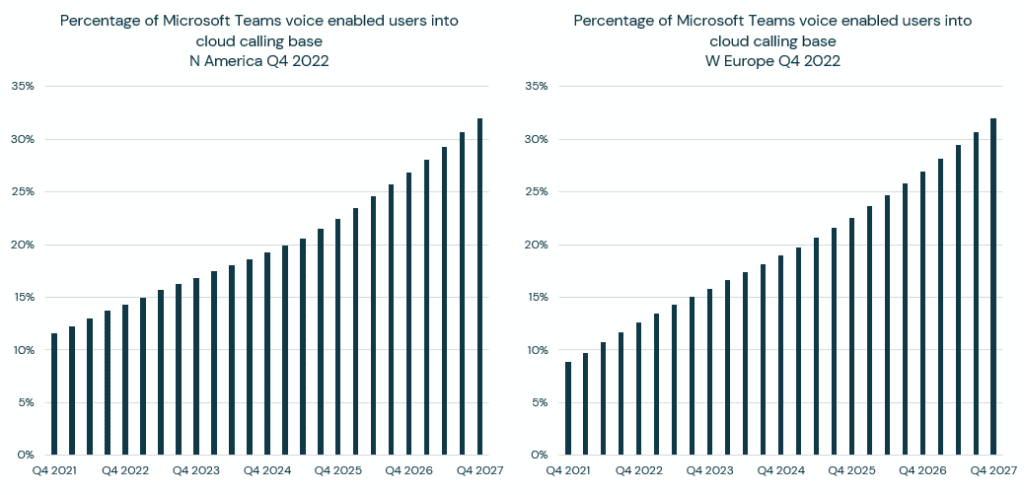

Currently only a small proportion of Teams users globally have PSTN telephony enabled. Cavell’s global data for the unified communications market and Teams telephony shows that the total number of Teams telephony enabled users is around 17 million (*this has subsequently been confirmed by Microsoft in its FY23 Q3 Earnings Release), that’s roughly 6% of the overall Teams user base. The vast majority, around two thirds, of those users are deployed in North America and Western Europe.

Microsoft Teams % penetration into cloud calling base, North America and Europe – Cavell Cloud Communications Market Reports Q4 2022

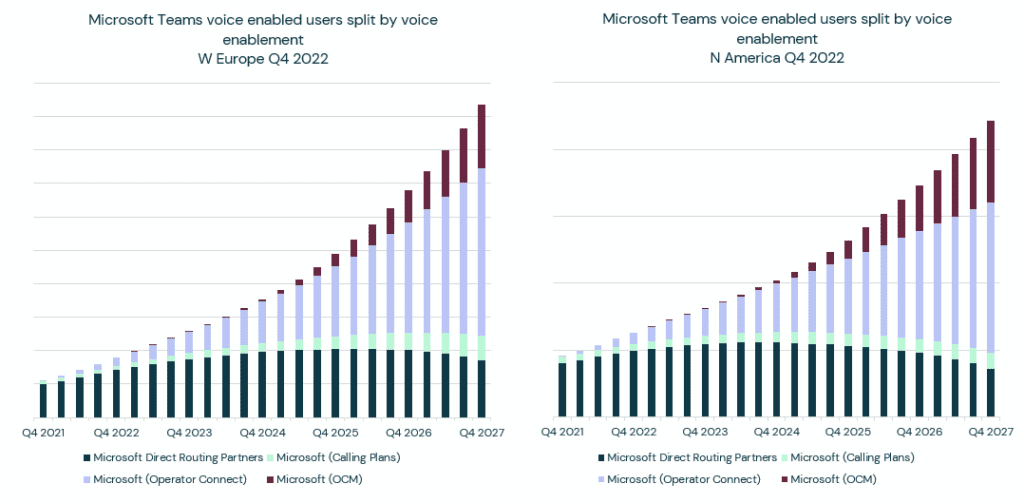

The scope for growth in this area is huge. Cavell’s forecasts for North America and Western Europe see the number of telephony enabled Teams users more than quadrupling over the next five years to reach more than 40 million by 2027.

There a few factors behind this estimated growth:

-

- Addition of Operator Connect and Teams Phone Mobile (previously Operator Connect Mobile [OCM]) – Microsoft have already certified more than 65 third-party operators through Operator Connect, but there are dozens on the waiting list. This shows a general plan to work in partnership with the telecommunications industry to boost the adoption of Teams telephony. Several mobile operators already have live Teams Phone Mobile solutions and this option has particular scope for growth in emerging markets where there is a higher propensity to utilise business mobile communication solutions.

-

- General growth – The Teams active user base has been growing by around 1.3% each month since the summer of 2021. This equates to nearly 3 million extra users every 30 days. This growth rate may slow, but if you continue to utilise the 6% telephony enablement figure, this roughly equates to an extra 150 thousand new telephony users being deployed month by month.

-

- ‘Pandemic return effect’ – Millions of users are going to return to their office locations and be faced with the same old phone systems that were in place pre-pandemic. Will they use them? Many business technology leaders are probably going to realize that the systems currently in place are not as effective as they once were, with users defaulting to collaboration hubs, such as Teams, for their communication requirements. This may well increase the proportion of Teams telephony usage as more businesses look to replace legacy systems and replicate their telephony functionality in Teams as an alternative.

The forecast growth in this area presents a huge opportunity, not just to Microsoft, but to the communications industry as a whole

Third-party Teams Telephony Market Booming

Although Microsoft does provide its own fully managed telephony solution in the form of Calling Plans, the vast majority of telephony enabled Teams users, more than 90%, look to third-party telephony experts to provide them with integrated services.

Third-party service providers, telcos, and communication vendors globally now enable telephony fucntionality in Teams, either via Direct Routing, through Operator Connect or through application integration.

Operator Connect – The latest addition option for adding voice/telephony services for Microsoft Teams users. Select PSTN operators have made their services – phone numbers and calling plans – available to provision directly from within the Teams Admin Center (TAC) . Enterprises will be able open an ‘Operators’ tab within the Admin Center and select phone numbers from the various operators and assign those numbers to individual Teams users. Users will require a Microsoft Phone System licence to enable PSTN connectivity through Operator Connect, either purchased as an add-on licence or one which is included within an Office 365 package such as E5.

Microsoft Operator Connect partners Q3 2022

Operator Connect Accelerator – There has been huge demand from telcos providers and service providers looking to become part of the Operator Connect program. Microsoft has already certified more than 65 Operators and there are hundreds currently in various stages of the application process. This is part of the reason behind the launch of the Operator Connect Accelerator, a program which allows a select group of approved Microsoft partners to provide software and services to telecom operators and service providers to accelerate their onboarding to Operator Connect and also provide ongoing support and assistance. Microsoft certified Operator Connect Accelerator partners currently include Azure for Operators (AfO), AudioCodes, NuWave, PingCo, Ribbon, and Sippio.

Microsoft Operator Connect Accelerator partners Q3 2023

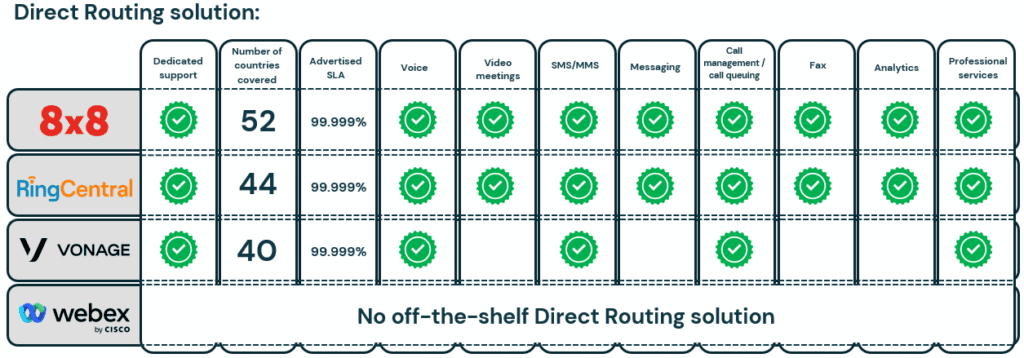

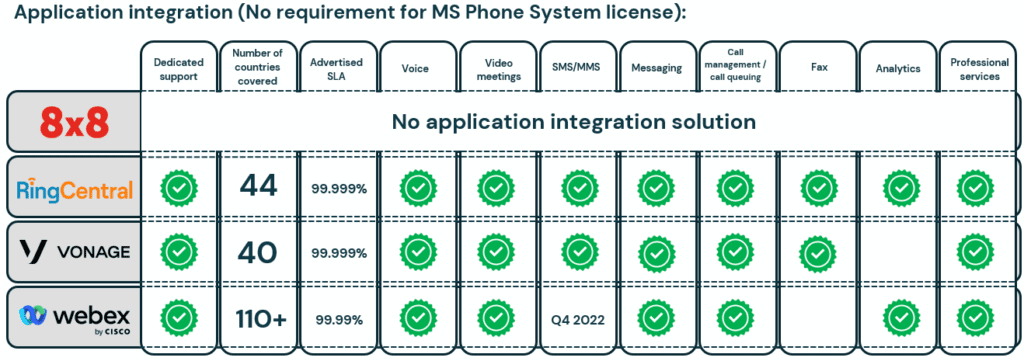

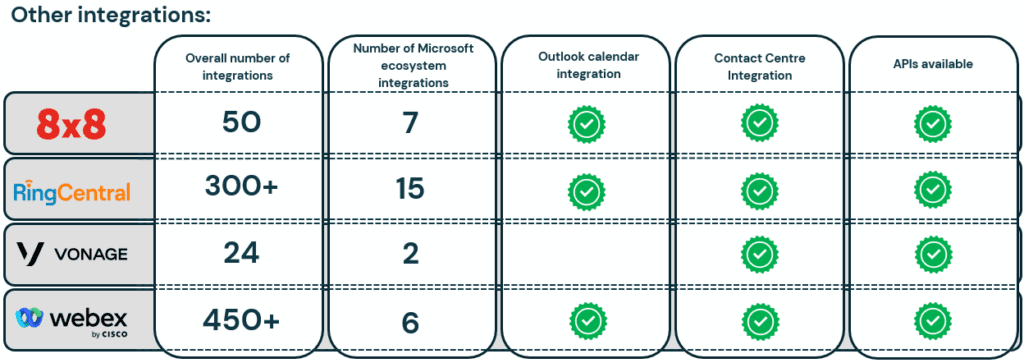

The world’s leading unified communications vendors have mobilised their own development to enable Teams telephony and wider integrations. Cavell has spoken to a selection of the leading providers – 8×8, RingCentral, Vonage, and Webex – to understand what they provision in each of the different areas. RingCentral offers the most comprehensive set of communications integrations for the Microsoft ecosystem, including offers across the different deployment telephony options for Teams. We have looked at the key criteria required in each area and compared offerings from the leading providers.

Direct Routing – Microsoft Phone System Direct Routing allows organisations to connect a certified Session Border Controller (SBC) to the Microsoft Phone System. This allows businesses to configure PSTN connectivity to equip the Microsoft Teams client with external voice capabilities. This configuration allows companies to utilise almost any trunking solution or interconnect alongside third-party PSTN equipment. Customer-owned telephony equipment such as pre-existing PBX systems and analogue devices can interoperate with the Microsoft Phone System using this method. For this to be enabled, Microsoft 365 users will again require a license with the Microsoft Phone System included.

Leading UC vendor Microsoft Direct Routing solution comparison

The Direct Routing option is by the far most popular scenario deployed by organisations who use Teams as a fully functioning phone system. More than 90% of voice equipped deployments use this method currently.

Application integration – Many unified communications providers offer Teams users an alternative to enable telephony within the platform. Rather than using Direct Routing or providing PSTN services via Operator Connect, the providers have used the Microsoft Teams Application library and developed applications that integrate their UC services into Teams. This option does remove the requirement for a Phone System licence, saving any organisation $8 (£6) per user per month. The best application integration options utilise an embedded dialler so that Teams users don’t have to open an additional application window to make calls and search contacts. Although this route to telephony does remove some costs, any users would obviously require a UC licence with the third-party provider and, depending on the provider, the integration may not provide the optimal native Teams user experience.

Leading UC vendor Microsoft Teams telephony application integration solution comparison

This option also allows the UC provider to enable additional call control and add features and functions that might be missing from Microsoft’s Phone System.

Wider Microsoft Integrations – As well as solutions specifically for Teams, providers globally have looked at the wider Microsoft software ecosystem, developing a host of integrations that enable communications within other applications. Integrations into Outlook are the most common, but they can be found across Microsoft’s portoflio, with communication providers offering meeting scheduling and collaboration possibilities directly within the market’s leading email solution. These integrations further demonstrate the relevance of Microsoft within the realm of communications and illustrate the ever-converging nature of technology solutions. Integrating different systems can improve operational efficiency and improve overall productivity.

Leading UC vendor integration comparison

Teams Telephony Forecasts

Currently Direct Routing is the most popular deployment method for telephony enablement in Teams. More than 80% of the telephony enabled users globally are deployed by Direct Routing. The market for Direct Routing has become increasingly competitive. At the start of 2020 less than 10% of the providers who participated in Cavell’s Global Service Provider Survey had a Direct Routing solution or product available. In the latest survey, conducted in 2022, this proportion had grown to more than 65%.

This means that majority of the telcos and service providers in the market have recognised the relevance of Teams telephony. There are now hundred of providers in this space offering Direct Routing-as-a-service for their customers.

Although Direct Routing formulates most of the Teams telephony market currently, Cavell Group’s data models forecast that Operator Connect is likely to overtake Direct Routing as the most popular option in the future.

Microsoft Teams telephony deployment option forecast – Cavell Group Cloud Communications Market Reports Q4 2022

There are various reasons driving Operator Connect. Firstly, the simplified end user deployment process, directly from within the Teams Admin Center, will appeal to many organisations. Huge industry demand to join the program will further drive adoption through this route with hundreds of the world’s leading providers promoting Teams telephony deployment through Operator Connect. The launch of the Operator Connect Accelerator program will improve the joining process for those providers and as the solution improves this will allow end user organisations to more easily couple the world’s leading collaboration solution with PSTN services from their preferred communication providers.

What does this mean for the industry?

The obvious point is that co-operation with Microsoft cannot be ignored. The Teams telephony market is forecast to cover more than 40 million users within the next few years across North America and Europe alone. The majority of service providers and telcos have recognised this opportunity already and have developed Direct Routing, Operator Connect, or application integration solutions to try and address this huge potential market.

As this article has shown, the world’s leading UC vendors are leading the way with solutions available across the different enablement routes. The industry must accept that telephony within Teams is a market opportunity that can’t be ignored.

Expanding on that, Microsoft plays such a critical role within the technology estates of a vast number of businesses globally. This, coupled with the growing importance of integration between systems – as technology convergence increases – means that organisations are now looking for operational efficiencies between their communications systems and their Microsoft platforms. Telcos and service providers must consider their role outside of just Teams, and evaluate how can their applications will work and improve end customers’ performance in other areas of the Microsoft software portoflio.

There is huge growth to come in Teams telephony, but the opportunity for the communications industry extends way beyond just voice enablement in the platform.

Cavell provides detailed marketing sizing. For more information on any of the topics or research cited in this article please get in touch with the Cavell team.

Share this post

Patrick Watson

Patrick is Cavell’s Research Director. His main area of expertise is the cloud communications industry, with a particular focus on the collaboration sector. For over 10 years, Patrick has been a noteworthy member in the technology community, with a degree specialising in broadcast journalism and data analytics.