Huge telephony opportunity explored during Cavell Enable 2023

Cavell hosted Cavell Enable on the 28th of November in London which brought together telcos, service providers, and partners specifically focusing on the opportunity around voice enablement. It was attended by over 200 guests representing over 85 service providers and included speakers from Microsoft, Cisco, and Zoom.

The event has more than doubled in size in 2023 attracting a wider range of communications providers and interested parties who are exploring telephony marketplaces within particular platforms. Gold sponsors Microsoft and Zoom both have specific marketplaces within their collaboration platforms, in Microsoft Operator Connect and Zoom Provider Exchange respectively.

Telephony marketplaces generating huge interest

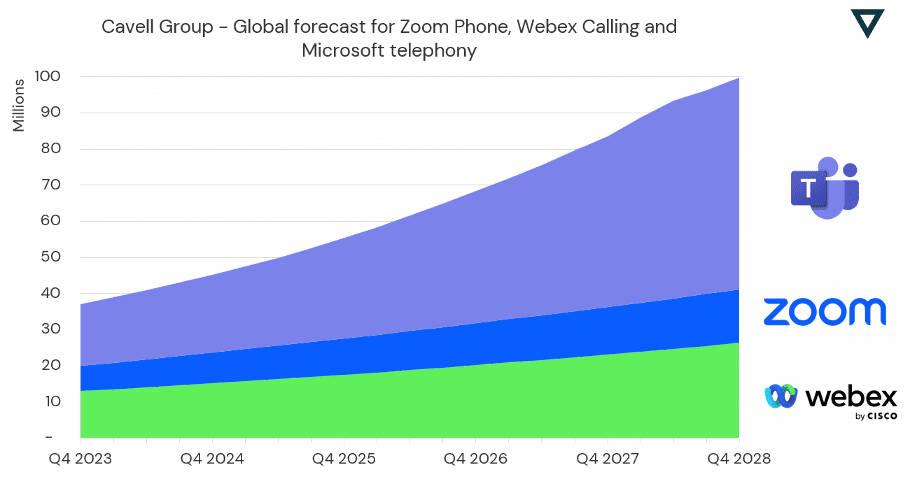

Interest in the event has increased as telephony ‘enablement’ marketplaces represent a growing opportunity. Cavell forecast that the number of telephony enabled users within Microsoft Teams, Webex Calling, and Zoom Phone will exceed 100 million by 2028.

Figure 1. Cavell Group forecast for Microsoft Teams telephony, Webex Calling, and Zoom Phone users.

Currently, the three leading collaboration applications offer internal PSTN telephony marketplaces where enterprises can, in theory, easily enable PSTN telephony services for their users from a selection of certified providers.

This level differs from traditional BYOC because of the selection of specific providers that are capable of delivering voice services via this route. The application, certification, and management process allow the platform providers to ensure compliance of providers to ensure QoS.

Dedicated telephony marketplaces with specific platforms and applications are becoming increasingly prevalent, although they do not represent the total telephony user base within these platforms, they still formulate a sizable proportion. Zoom for example have said that out of its 7 million Zoom Phone users, more than half are enabled by ‘bring your own’ (BYO) carriers or through their Provider Exchange.

Although currently these types of market are only present within collaboration applications, there is potential for growth of this model in other software platforms, such as contact centre or CRM platforms.

Commercial models and enterprise requirements key for service providers – Catie de Marcillac’s thoughts from Cavell Enable

Enable was unsurprisingly heavily centred around Microsoft Teams and the opportunity for providers to add value to the Teams stack as traditional margins and revenue streams come under increasing pressure. Patrick Watson’s opening keynote centred around the telephony marketplace which encompasses integrations into collaboration platforms and third-party systems. Currently, 75% of end-users with a collaboration solution integrate into a productivity tool such as Microsoft 365 and G Suite, and 53% also integrate into another communication system such as telephony, mobile and contact centre. This integral link between collaboration, telephony and contact centre leads to a wider opportunity for providers to offer wider CX services outside of traditional telephony offerings.

As revenue generation remains the real contentious issue for providers, value-adds will act as a fundamental approach for providers to maintain relevance, with companies such as Akixi, Tollring, and AudioCodes all having developed advanced solutions to compliment collaboration platforms. Contact centres, other customer experience services, and CRMs will inevitably also play a role in this game as the industry converges and standalone telephony solutions become too basic for enterprises. Indeed, at the event, 42% of the audience members reported that Contact Centre provides the best opportunity for revenue generation in conjunction with collaboration telephony, showing the strong opportunity in the convergence between UC and CC.

This story was very much echoed by representatives from legal firm Norton Rose Fulbright, national standards body BSI and engineering company AtkinsRéalis, who all gave their insights into using Microsoft Teams within their organisations in Tom Arbuthnot’s panel. The session provided perspective for providers and telcos in the audience, as often the actual usage of collaboration at the enterprise-level can be underexplored at industry events which normally focus heavily on the vendor and provider narrative.

All three enterprises used Microsoft Teams Phone as part of the wider Microsoft 365 estate, making the platform a crucial ‘one-stop-shop’ for users and showing the importance of integrated platforms and multi-service offerings for enterprises to avoid siloed, separate technology stacks.

However, there were several challenges highlighted with the Teams Phone and collaboration experience, particularly due to the constant updates and new feature to the platform which makes it hard for enterprises to keep on top of, requiring constant end user retraining and management. The release of Copilot has also caused some disruption for enterprises due to its price point being a barrier for even these larger companies to invest in for every user. Ally Ward from Norton Rose highlighted that she had been trialling Copilot already and its major benefit was in file finding, but not so much for its content creation abilities which – according to her – have a way to go. While these pain points cause issues for enterprises, they also provide providers with an opportunity to deliver a much-needed value-add to their portfolios by offering more advisory services for businesses to help improve their usage of Teams and the wider 365 stack, including training organisations on how to utilise Copilot effectively and keeping them up to date on the latest software updates and innovations.

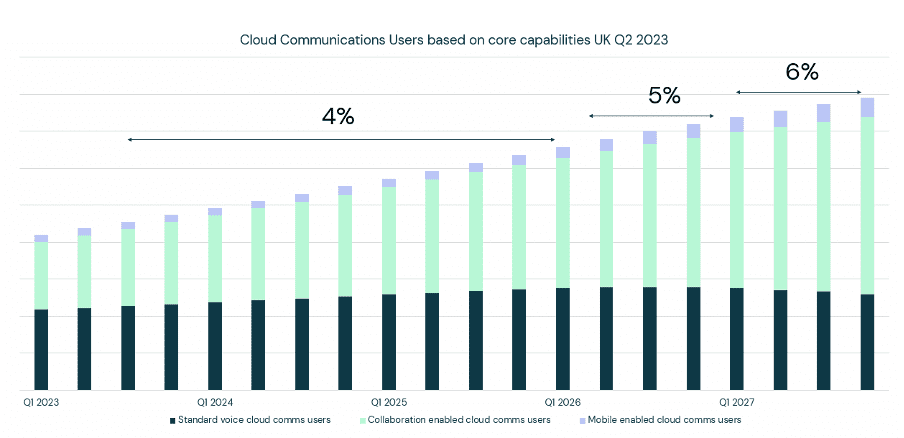

It’s also clear that enterprises are re-examining their employees’ usage and experience of Teams and rationalising their portfolios as a result. Damian Lewis from BSI highlighted that there are many users in the organisation that don’t need a phone number assigned to them, and Matt Ellis from AtkinsRéales also detailed that some workers in his organisation were looking at moving away from an E5 license to an E3 license as they didn’t need all the bells and whistles that E5 provides. This is a trend that Cavell have been closely monitoring in recent years and we are forecasting that as collaboration becomes more and more popular, the telephony available market will reduce slightly as more and more business move to collaboration-only solutions with no need for a PBX.

Despite this, Cavell are still forecasting major growth in telephony-enabled users between now and 2028. This shows that service providers and users are still taking a multi-vendor approach, a point which was reiterated in the Telephony in Collaboration panel moderated by Dom Black with Roy Dehing from Microsoft, Jason Gilligan from Zoom, and Marcel Kardol from Cisco. While it’s clear that Microsoft is currently leading the market, there is still plenty of opportunity for a multi-platform approach, with most service providers and telcos offering more than one solution for customers. This was shown most distinctly by the survey results from the panel, where 47% of the Enable audience said they offered telephony across 1 or 2 platforms, but 38% said they offered telephone across as many platforms as possible.

Microsoft announcements and the future of mobile – Finbarr Begley’s thoughts from Cavell Enable

The Cavell Enable 2023 event was everything I love about the telecoms industry: new approaches to technology, open discussions about the market and loads of enthusiasm for the ‘next big thing’. As expected from an industry leader, Microsoft brought some of the more interesting new concepts with it. Copilot, Microsoft’s AI assistant, seems to grow in capability, scope, and depth. It seems like the sort of tool that I’d be delighted to get my hands on, though as someone working for a small business, I don’t know the pathway to Copilot for my kind of company. Copilot is restricted commercially as it requires a 300-user commitment with a $30 price tag per user per month, equating to a $9,000 investment annually.

Microsoft Mesh was also discussed; this new product seems to be Microsoft’s new Team avatars being used to interact in virtual spaces, either meeting rooms or immersive spaces with multiple meeting rooms people can walk between. This isn’t a particularly new idea; at the start of the pandemic, several companies were creating a virtual environment filled with avatars where impromptu video calls could spring up when two got close together. Despite the appeal of avatars to a subset of the workforce, it’s hard to imagine a world where this idea becomes widespread compared to the simplest form of communication – just calling people. Still, it’s hard not to be excited by these sorts of experiments and the potential for making people more engaged on video calls and letting people of different energy levels input better into digital conversations by using body language cues to interrupt the flow of dialogue.

I was also quite interested in another discussion that happened later, during a panel on ‘Going Mobile’, hosted by Cavell’s Alastair Buck, with Attendees from Dstny, Microsoft, VMO2, Tango Networks, and BT. One idea that came out of the panel was the idea that mobile phone numbers should be tied to roles rather than individuals. I’d say it’s fairly common practice for a mobile number to belong to an individual at a company and to follow that individual even if they leave. However, it was argued that as workers stay at companies for shorter periods than in the past, this creates potential business continuity risks. Why should your customers risk calling a number that no longer exists, belongs to an ex-employee, or must update their own records when they can just keep calling the same number and be connected to the new employee? Many customers now just want consistent service and don’t care about the employee they are reaching out to, especially if it’s likely that the employee will change during their contract tenure.

Figure 2. Cavell Group forecast for type of cloud communications users in the UK

Another thought I’ll leave you with from the show is that it’s relevant to this discussion of mobile and FMC came from the same panel. As smartphones get more capable, does the mobile network matter anymore if it can provide data? One of the panellists said that they were starting to reframe their considerations for mobile services less on the mobile network’s capabilities and more on the capabilities of the device once it had a 4G connection for data. It’s not a groundbreaking revelation, but it is quite telling that with the spread of 5G, and more and more inter-operator agreements to provide no-spot coverage, we are reaching a point where the majority of people in the country – over 91% of the UK has access to at least one MNO though the quality is far from guaranteed -, having data isn’t the question, and what you do with it is.

Cavell Enable will be returning in 2024 so for more information on content, participation, and sponsorship opportunities reach out to the Cavell team.

Patrick Watson

Patrick is Cavell’s Research Director. His main area of expertise is the cloud communications industry, with a particular focus on the collaboration sector. For over 10 years, Patrick has been a noteworthy member in the technology community, with a degree specialising in broadcast journalism and data analytics.